If you foresee profits through your crypto dealings, ensure that you do it based on a proven strategy. Once you turn to a strategy, it will help you do the dealings with a focused approach. Strategy becomes all the more critical when the news statements revolve around this, followed by the economic developments that can interrupt the market analysis.

Cryptos are a new investment class, and very little data is available; past performance should be considered. Now, if you want to soar high on the risk and returns, there are some tips that you need to know about:

The industry experts and analysts suggest that many cryptos like Dogecoin that were a market value of Rs. 10,000 have now reached a market value worth Rs. 5.75 lakhs. There are high chances that you’ll be carried away with these numbers and begin to invest heavily in cryptocurrency. However, you should follow some rules that will help you do better trading tips.

1. Say No To Big Debts

Source: pixabay.com

The first tip is that don’t fall into the pit of significant debts. Many industry experts and traders suggest that putting your whole budget into investing in cryptos is undoubtedly not the right thing to do. Instead, it would help if you did planning before making investments. Before investing, you should draw familiarity with different coins and other trends to better analyze and comparative study of different cryptos’ real prospects and value. The crypto portfolio should not see more than 2% of your total portfolio investments.

2. Don’t Let Volatility Scare You

Once you are in the game, you will be in a better position to learn about the insights. You will only learn about the different forms of cryptos and their ups and downs when you invest in them. But, it would help if you did not forget that the risks are exclusively high. High risk means that they are prone to market fluctuations. It will give rise to their volatility. The crashdown can be huge, and once you know how to deal with it and that it’s a part of the dealing process, you will be in a better position to do the dealings.

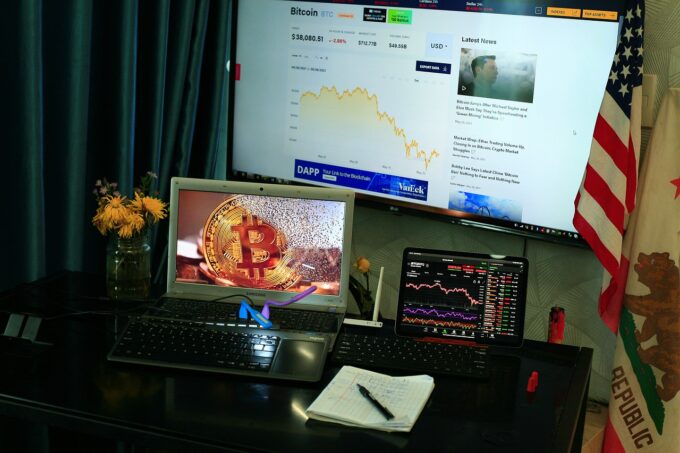

3. Importance Of A Trustworthy Platform

Source: pixabay.com

The crypto world is evolving, and it is essential to know that regulations are not in place in many countries. The global governments are still working on the regulations; hence, studying the rules and guidelines takes time. Hence, it is imperative to use a reliable platform for the same. Investors need to be more than careful when it comes to choosing the platform that is authentic and keeps the data safe. Also, it should be a simple interface that helps investors explore their options. You can consider exploring the bitcoinscircuit.app and check out the programs and functions for you in the crypto field.

Also, verification is a must beforehand and hence, and you should do the same. The crypto world poses a challenge in the form of information credibility; hence, you should not act without confidence in the authenticity.

Moving on, some strategies will help you bag better deals and profits in cryptocurrency dealings. You can try the following strategies.

4. Scalping – The Popular One

Let’s cover this one as it is the first strategy and the most trusted one for trading. It allows global traders to gain profits when there are slight price fluctuations, no matter if they happen at frequent intervals. The idea behind this strategy is to help investors with small yet added profits; hence, the trader will end up with a substantial amount in some time.

5. Day Trading Processes

Source: pixabay.com

The next one stands for day trading. It does not mean trading in the day. Or, would it be acceptable to say that slightly?

Are you wondering about the idea behind this confusion?

In day trading, the traders enter and exit their positions while trading daily. The idea behind this is to capitalize on the price movements. The concept is related to the price movements in one day of trading. This kind of strategy’s timeframe is higher than the process discussed above.

6. The Swing Trade Strategy

The next one is also time-based. This is common among the investors as it is a medium-term one. However, the period in this one is not for a single day but some weeks or months. Hence, if a trader is facing issues related to trading and the time period for deciding whether they want to go for buying and selling or not, they can go for this one. They can use this strategy to buy more time and hence, spend this time reconsidering their decisions.

7. Buy And Hold In The Form Of Position Trading

Source: pixabay.com

This one helps the traders hold the trading positions for a considerable time. The period is not for some days but for some weeks, months, and even years. This strategy helps avoid the small-term fluctuations in the price; hence, they can use this trading for fundamental analysis. It helps evaluate the prevailing trends in the market trends and prices. Also, you can consider many other factors and trends to make the final investment.

There is one more strategy that can help you enhance your crypto experience. This means buying different currencies from one platform and beginning selling on another. The trader can opt for advantages with the help of correlation in reducing prices amongst various assets. There can be two or more two exchanges. Such opportunities are limitless as there is no limit to the availability of spot market exchanges on the global platform.

Scaling is a good option if you want to choose the best one. It will keep you in a comfortable space even if you want to spend considerable time doing the dealings. However, swing trading will be helpful if you want to go for specific alternatives.

Conclusion

That’s all about the crypto trading and tips. You can consider keeping a check on them for a happy trading experience.