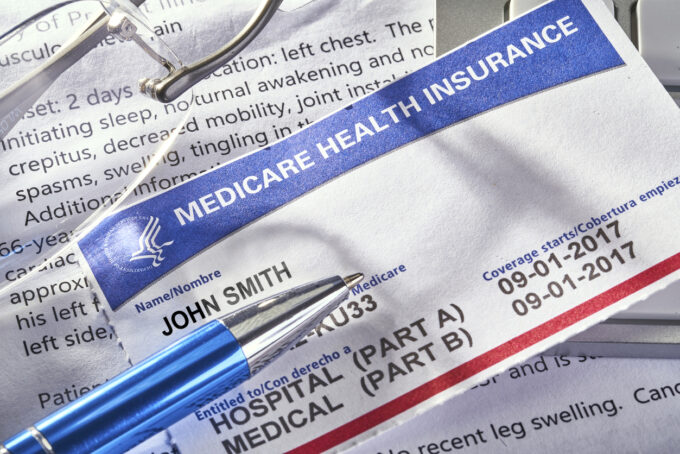

The Medicare Advantage plan often plays a role as a substitute for the Original Medicare plan that includes Part A and Part B. If someone has Original Medicare that covers hospitals and medical treatment costs, why would you want to switch it with something else?

The Medicare Advantage plan is a private plan that provides more comprehensive coverage than Original Medicare. For example, with the Advantage Plan, you can receive acupuncture coverage and other forms of complementary medicine. More importantly, there is a wide array of medical supplies available too.

The best Medicare Advantage has to offer is the eye care and dental benefits. This is a big reason why people decide to switch from Parts A and B and choose the Medicare Advantage plans instead.

However, replacing Original Medicare isn’t as simple as you may have thought it would be. You can only do so in the specific time of the year. In the article, we will talk more about switching between plans and how to prepare and go through this process.

Switching Between Original Medicare and Medicare Advantage

Source: parade.com

In most situations people switch plans as they have original Medicare (Part A and Part B) usually combined with the Medicare Part D, which is a prescription drug plan. Before you transition, you should know that Medicare Advantage plans are all-in-one plans.

In other words, Medicare Advantage covers both Part A & B together with Part D and some other benefits and services that are not in the original plans, as you can see at medigap. We’ve already mentioned dental and vision, but you will also get hearing coverage, as well as gym memberships if you want to maintain a healthy lifestyle.

The reason why many people choose Medicare Advantage over the original plans is because there is also a cap on the out-of-pocket costs to keep your finances in check.

There are several time frames during which you can either enroll in Medicare Advantage and they are listed below:

- The Initial Enrollment Period – if you have just become eligible for Medicare (turned 65 or about to turn 65), you can immediately go with the Advantage plan.

- The Open Enrollment Period – this starts on October 15 and lasts until December 7. This window is open each year for people to make adjustments in their Medicare plans. If you find it necessary, you can either add the Part D to your original Medicare or choose Advantage instead.

- The Medicare Advantage Open Enrollment Period – this runs from January 1 to March 31 and is known as the open enrollment period when you can switch between different plans. If you have an Original Medicare and you want to select Advantage, this is the time to do it. The good news is that you can always return to the Original Medicare in the same period next year.

Key Differences

There are some key differences between two plans. First of all, with the Advantage plan, you don’t need to buy any additional coverage. Secondly, you will not have a standalone plan such as Part D. As we’ve already said, the Advantage plan covers everything. Lastly, with the cap on out-of-pocket spending you don’t have to worry too much about these additional costs that can occur during the treatment.

What Should You Do After You Enroll?

Source: ncoa.org

Now that you know when you can select the Advantage plan and know how it differs from the original Medicare, you must be wondering what the process is. Once you enroll in a Medicare Advantage during the annual enrollment, you will not be required to contact Medicare. Everything will be ready for you to start using the new plan on January 1.

If you have any individual plan such as Part D or any of the Supplement Plans that you purchased from official Medicare providers, you will need to get in touch with them in order to dis-enroll. This is a simple process, but it will require your action.

Medicare Advantage Plan Prices

Source: patientbond.com

Medicare releases pricing for their plans in advance of the annual Medicare Open Enrollment in order to help the beneficiaries decide which plans to choose. On average, the monthly premium for Advantage this year is lower, at $19, compared to $21.22 in 2024. For example, the Part D coverage is $33 per month compared to $31.47 in 2024.

The number of Advantage enrollees increases and for a reason. It appears that lower monthly premiums and overall coverage attracts a lot of people to switch from the original Medicare.

“We are committed to ensuring that the health system and Medicare work for people, their families and their providers,” said CMS Administrator Chiquita Brooks-LaSure. “Open Enrollment is the one time each year when more than 63 million people with Medicare can review their health care coverage to find new plans or change existing plans, discover extra benefits and help them save money.”

At this point, we have no information about potential monthly premiums for 2024. The prices will be announced by Medicare before Open Enrollment.

The bottom line…

There are major differences between the Original Medicare and Medicare Advantage. First of all, the Medicare Advantage plan offers more coverage and it includes dental, visual and hearing healthcare. Furthermore, we’ve seen that Medicare Advantage doesn’t require any additional plan such as Part D, which is a good addition to the Original Medicare.

The process of transition between the two plans is simple. All you have to do is wait for one of the enrollment periods and you can switch between plans. It is important to consider your needs for every year and switch when you find it necessary. Your health may change and you may require more or less care in the upcoming year.

As for the prices, the Medicare Advantage monthly premium average is $19 this year while the price for 2024 remains to be announced at the end of the year. To learn more about Original Medicare & Medicare Advantage Plans, you should visit MedicareConsumer.com – here you can compare plans and get free rate quotes from top Medicare insurance providers within several minutes.